What Is The Restaurant Food Tax In Virginia . virginia restaurant tax: the city’s meals tax is managed by the department of finance’s business unit. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. This tax is applied to most food products, including groceries and prepared meals. you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. The meals tax (also known as the food and. the food tax in virginia is currently set at 2.5%. There is a 2.5% tax on food in general, but in certain.

from www.formsbank.com

you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. the food tax in virginia is currently set at 2.5%. There is a 2.5% tax on food in general, but in certain. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. virginia restaurant tax: the city’s meals tax is managed by the department of finance’s business unit. The meals tax (also known as the food and.

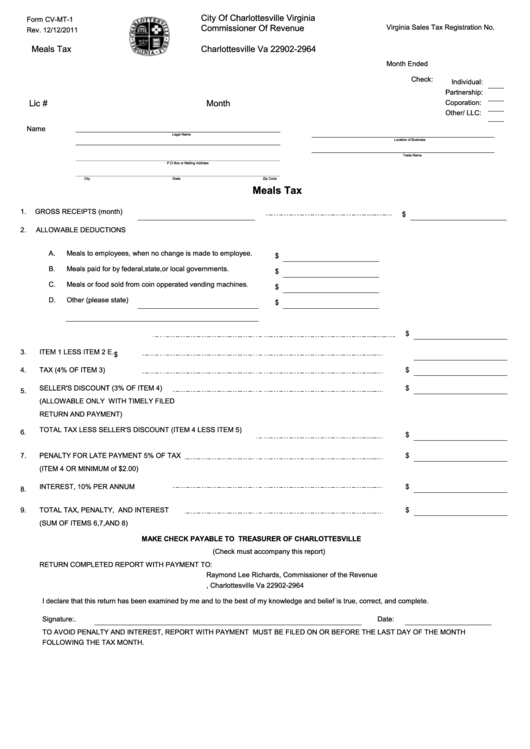

Form CvMt1 Meals Tax City Of Charlottesville Virginia printable

What Is The Restaurant Food Tax In Virginia the food tax in virginia is currently set at 2.5%. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. the food tax in virginia is currently set at 2.5%. you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. virginia restaurant tax: fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. There is a 2.5% tax on food in general, but in certain. This tax is applied to most food products, including groceries and prepared meals. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. The meals tax (also known as the food and. the city’s meals tax is managed by the department of finance’s business unit. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%.

From www.formsbank.com

Guidelines For The Prepared Food And Beverage Tax With Instructions What Is The Restaurant Food Tax In Virginia you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. This tax is applied to most food products, including groceries and prepared meals. virginia restaurant tax: There is a 2.5% tax on. What Is The Restaurant Food Tax In Virginia.

From www.cainwatters.com

Meals & Entertainment Tax Deductions for 2024 What Is The Restaurant Food Tax In Virginia The meals tax (also known as the food and. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. This tax is applied to most food products, including groceries and prepared meals. the food tax in virginia is currently set at 2.5%. you can read virginia’s guidance on. What Is The Restaurant Food Tax In Virginia.

From www.signnow.com

Va Sales Tax Form Fill Out and Sign Printable PDF Template airSlate What Is The Restaurant Food Tax In Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. the food tax in virginia is currently set at 2.5%. As of january. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Food And Beverage Tax Form Virginia Commissioner Of The Revenue What Is The Restaurant Food Tax In Virginia This tax is applied to most food products, including groceries and prepared meals. the city’s meals tax is managed by the department of finance’s business unit. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. The meals tax (also known as the food and. the food tax in virginia is currently set. What Is The Restaurant Food Tax In Virginia.

From www.livemint.com

Restaurant's service charge row Taxes, charges you pay on your food What Is The Restaurant Food Tax In Virginia There is a 2.5% tax on food in general, but in certain. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. This tax is applied to most food products, including groceries and prepared meals. The meals tax (also known as the food and.. What Is The Restaurant Food Tax In Virginia.

From www.besttemplates.com

Restaurant Tax Invoice Template in Word, Excel, Apple Pages, Numbers What Is The Restaurant Food Tax In Virginia you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. The meals tax (also known as the food and. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. virginia restaurant tax: This tax is applied to most food products, including groceries. What Is The Restaurant Food Tax In Virginia.

From www.vrlta.org

Meals Tax VIRGINIA RESTAURANT, LODGING, AND TRAVEL ASSOCIATION What Is The Restaurant Food Tax In Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. the meals tax is levied on food and beverages sold by restaurants as. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Food And Beverage Tax Report Form printable pdf download What Is The Restaurant Food Tax In Virginia you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. The meals tax (also known as the food and. There is a 2.5% tax on food in general, but in certain. This tax is applied to most food products, including groceries and prepared meals. virginia restaurant tax: the city’s meals tax. What Is The Restaurant Food Tax In Virginia.

From www.templateroller.com

Prince County, Virginia Meals Tax Remittance Form Download What Is The Restaurant Food Tax In Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. This tax is applied to most food products, including groceries and prepared meals.. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Fillable Meals Tax Form Charlottesville, Virginia printable pdf download What Is The Restaurant Food Tax In Virginia you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. The meals tax (also known as the food. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Meals Tax Computation Form Virginia Commissioner Of The Revenue What Is The Restaurant Food Tax In Virginia As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. This tax is applied to most food products, including groceries and prepared meals. effective july 1, 2022,. What Is The Restaurant Food Tax In Virginia.

From www.jagoinvestor.com

Service Charge, Service Tax and VAT on Restaurant/Hotel Bills What Is The Restaurant Food Tax In Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. fresh produce and groceries are taxed at a reduced rate of 2.5%,. What Is The Restaurant Food Tax In Virginia.

From ceaicrwg.blob.core.windows.net

How Much Is Restaurant Tax In Va at Melissa Brown blog What Is The Restaurant Food Tax In Virginia you can read virginia’s guidance on what constitutes “prepared hot food sold for immediate consumption” here. virginia restaurant tax: fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. the meals tax is levied on food and beverages sold by restaurants. What Is The Restaurant Food Tax In Virginia.

From www.templateroller.com

Petersburg, Virginia Meals Tax Form Fill Out, Sign Online and What Is The Restaurant Food Tax In Virginia virginia restaurant tax: effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. The meals tax (also known as the food and. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. . What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Meals Tax Remittance Form Prince County Virginia printable pdf What Is The Restaurant Food Tax In Virginia the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. This tax is applied to most food products, including groceries and prepared meals.. What Is The Restaurant Food Tax In Virginia.

From www.reddit.com

Virginia's Grocery Tax r/Virginia What Is The Restaurant Food Tax In Virginia This tax is applied to most food products, including groceries and prepared meals. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as stamps and gasoline are exempt from the. the food tax in virginia is currently set at 2.5%. you can read virginia’s guidance on what constitutes “prepared. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Meals Tax Monthly Report And Remittance Form City Of Fairfax What Is The Restaurant Food Tax In Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. the food tax in virginia is currently set at 2.5%. the meals tax is levied on food and beverages sold by restaurants as defined in the code of virginia and section 20 of the county code. virginia. What Is The Restaurant Food Tax In Virginia.

From www.formsbank.com

Bristol Virginia Meals Tax Form Commissioner Of The Revenue printable What Is The Restaurant Food Tax In Virginia There is a 2.5% tax on food in general, but in certain. As of january 1st, 2020, the average tax on prepared foods in virginia is 5%. the city’s meals tax is managed by the department of finance’s business unit. fresh produce and groceries are taxed at a reduced rate of 2.5%, and all medicines as well as. What Is The Restaurant Food Tax In Virginia.